Send App, a cross-border remittance product of Africa’s largest payments startup Flutterwave, has launched a physical Naira card for Nigerians returni

Read MoreFor millions of South Africans, the South African Social Security Agency (SASSA) grants are a critical lifeline, and the December payment dates are no

Read MoreStitch, one of South Africa’s largest payments fintech startups, has partnered with Capitec Bank, the country’s largest retail bank by customer base,

Read MoreVerve, a payment card scheme operated by Nigerian fintech company Interswitch, is expanding its contactless payment products and introducing tokenisat

Read MoreVodacom’s Tanzania arm has launched M-Pesa Global Payment, a suite of new international payment features on M-Pesa that allow its over 22 million user

Read MoreMoMo Payment Service Bank (MoMo PSB), the fintech platform of Nigeria’s largest mobile network operator, MTN, has inked a strategic partnership with T

Read MoreFusepay, a Seychelles-founded fintech building payment tools for frontier markets, has launched its digital payment platform to help businesses in the

Read MoreFor the past year, Nomba, a Nigerian fintech last valued at over $150 million, has been establishing operations in the Democratic Republic of the Cong

Read MoreZeeh Africa, a Nigerian open-finance startup that builds APIs to enable businesses to verify customers and access their bank data, has relaunched its

Read MoreSince 2017, at least 10 million Muslims have travelled to Mecca, Saudi Arabia, yearly—except during the pandemic years of 2020 and 2021—to perform Umr

Read MoreMoni, a Y Combinator-backed Nigerian fintech offering community banking services, has rebranded as Rank and acquired AjoMoney, a group savings platfor

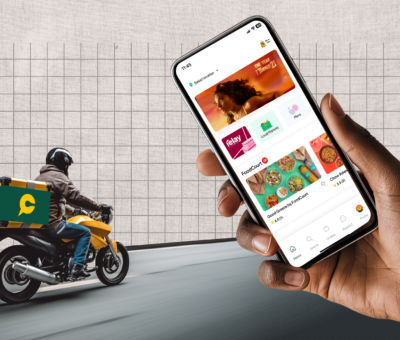

Read MoreChowdeck, the Nigerian on-demand delivery platform, is no longer just delivering meals. With a new feature that lets users pay bills, it’s now deliver

Read MoreMukuru, one of Africa’s largest digital financial services platforms, has partnered with AI-powered banking platform JUMO to launch Fast Loan, a mobil

Read MoreMTN Nigeria’s fintech arm made ₦131.62 billion ($91.64 million) in the first nine months of 2025, but mostly on the back of airtime lending (Xtratime)

Read MoreFlutterwave, Africa’s largest payments infrastructure company, is betting on stablecoins to make cross-border transactions faster and cheaper through

Read MoreNigeria’s House of Representatives, the 360-member lower chamber of the National Assembly, is considering a bill sponsored by Hon. Fuad Kayode Laguda,

Read MoreManaging business finances in Africa typically involves using scattered tools: accounting and budgeting softwares, banking and payroll apps, multiple

Read MoreImagine backing one of Africa’s quietest giants before the crowd caught on. Today, that small company, Moniepoint, is now worth over $1 billion. Monie

Read MoreOn Thursday, Raenest, a Nigeria-based cross-border remittance company that offers multicurrency accounts for freelancers and businesses, unveiled four

Read MoreMoniepoint’s London remittance bet has cost it $3.77 million since February 2024, according to UK regulatory filings. Moniepoint Group set aside $7.39

Read More